05-09-2024

Hungary

Outsourcing

digitalization, digital transformation, touchless accounting, automation, AP processing, accounts payable processing

If you prefer watching the podcast instead of reading, click here:

PS In-Voice – PS APPS Touchless Accounting, the Next Step in the Evolution of Accounting

Please, do not forget to set the subtitle to the preferred language.

If you prefer reading, this article below is for you… 🙂

A cikk elolvasható magyarul is a PS HU karrieroldalán >>

PS In-Voice – PS APPS érintésmentes könyvelés… Újabb lépés a könyvelés evolúciójában

During the discussion, our experts emphasized that the goal of automation is not to reduce the work of accountants but to enable them to focus on higher-value tasks rather than time-consuming manual data entry. With the help of the PS APPS system, invoice registration, approval, and accounting all occur on a shared platform, ensuring not only efficiency but also accuracy.

Looking ahead, the experts highlighted two main directions: further exploration of AI applicability and expanding integrations to make the system even more widely applicable. PS APPS has already received positive feedback from the market, and PS aims to continue developing it as an integral part of their accounting services based on client needs.

This podcast provides valuable insights for anyone interested in the digitalization and automation of accounting processes.

Andrea: Welcome everyone to Process Solutions’ YouTube channel. This is PS In-Voice, where we regularly discuss professional accounting issues with our expert colleagues. We talk about accounting, payroll, taxation, and recently, the technological innovations that are increasingly interesting to us, such as robotization and automation.

I am Andrea Mondy, and today, my two guests are PS’s two development experts: Attila Sólyom, Digital Transformation Director, and Lőrinc Vaskuti, Manager.

Today, we will discuss a very exciting topic: touchless accounting. It sounds a bit like science fiction… It feels to me like a driverless car. Attila, what exactly is touchless accounting?

Attila: Good question, and it really does resemble a driverless car. Perhaps I would start from the point that the next step in the evolution of accounting is touchless accounting. If you think back, we first wanted to support accounting with software, and then 20-30 years ago, software was introduced. We tried to automate it as much as possible and make it paperless. Paperless accounting has been very popular and remains so to this day. The next step is to make paperless bookkeeping touchless. Touchless means minimizing the need to interact with the system. You don’t necessarily need to physically touch paper, or even type something into a system. The fewer times you have to do this, the better you can perform your work without interruptions and concentrate on creating real value-added work.

Andrea: Today, we have a support system for this: PS APPS. This is the integrated system that can support all the background processes in the entire accounting process. What exactly is PS APPS, and what modules or parts does it have?

Lőrinc: In practice, PS’s client base consists of large multinational companies in Hungary. Despite the digital nature of these companies, many still file their invoices in Excel, and sometimes even on paper, with the managing director signing the invoice by hand. We often encounter this, and our role typically begins here, where we start recording already filed and approved invoices from scratch. PS APPS effectively changes this. It is an integrated solution linked to our accounting software, transforming the accounting process so that we work with the client, avoiding duplication. The invoices are filed within PS APPS, approved there, and since it’s a continuous process, we can also support bank transfers. By the time the invoice is filed for approval with the client, it is already in the accounting program. We can also automate the accounting steps by setting rules on an intermediate interface.

Andrea: Then real-time data plays a crucial role in this system, if I understand correctly.

Attila: Yes, if touchless accounting is evolution, then continuous accounting is the other crucial factor. It’s a type of accounting where data is live, readable, and interpretable by users, providing ongoing information to the business rather than waiting for the closing process.

Andrea: So accounting and financial support are not separated within this system.

Attila: Exactly, and it also supports leadership.

Andrea: I see. And how are the roles of automation and human intervention divided within this system?

Attila: You might think we’re doing this to reduce the number of accountants needed, but that’s not the case. We’re doing it so that accountants can focus on what they really know and add value. I often compare it to the transformation of journalism: before the internet, journalists worked with paper media, which have now largely disappeared. However, journalists still exist, but now they work digitally. Accountants should see this as a similar advance. We want them to use their knowledge effectively and avoid repeating tasks unnecessarily. This system was developed so that once you interact with it, you don’t have to touch it again. The goal is 100% accuracy.

Andrea: 100% accuracy? That sounds exciting, especially in a profession where almost right is not good enough—everything must be perfect. What makes PS APPS different from other systems on the market?

Lőrinc: This is a modular system. Different parts can be turned on or off depending on the needs. For example, in a large company with a well-established approval system, we can skip that part of PS APPS and only use the automatic accounting module, called Brain. The system’s modularity and 100% accuracy set it apart from others. We do not rely on statistical methods like traditional AI. Only the correct solution is accepted.

Andrea: Yes, it is common for supplier invoices to be for recurring services.

Attila: Or for very similar services from other suppliers. As a service provider, we cannot afford to guess what constitutes proper accounting. Unlike popular solutions, we insist on 100% accuracy.

Andrea: If I understand correctly, in a well-parameterized system, the possibility of errors decreases. Moreover, if errors do occur, it’s easier to correct them because they are type errors rather than individual errors.

Lőrinc: Yes, exactly. The accountant sets up the rules in Brain, ensuring that the work is done once, correctly. For recurring invoices, the system will automatically handle them in the future. If a new service or product appears, the accountant sets it up once, and the system takes care of it.

Andrea: This certainly makes everyday work easier. It also shows that this investment is worth it and brings returns. But can it impact business growth or cost efficiency?

Attila: We developed this with a dual purpose: to benefit ourselves as a service provider and to create value for our clients. It’s like renting an accounting production line. For small and medium-sized businesses, this system formalizes and standardizes the process, making it transparent. For larger companies, the benefits of economies of scale come into play.

Andrea: What is the volume at which significant savings can be achieved?

Attila: We’re talking about thousands or tens of invoices per month. At this volume, the return on investment is significant.

Andrea: And how much time can this save, for example, for an accountant who spends about 40% of their time recording data?

Attila: With a reasonable volume, the time spent can be halved.

Lőrinc: Yes, definitely.

Andrea: Let’s talk a bit about the technology behind this. This is a proprietary development by PS. Who developed it, and what makes it special?

Attila: It’s a modular system. The basic service is accounting, but additional services can be turned on or off depending on the client’s needs. This is the result of internal development and the use of purchased and in-house developed software. These modules are integrated, communicating with each other and feeding data back to the accounting system.

Andrea: What are your visions for this system? What do you see as the future for it?

Attila: Two areas stand out: further AI integration and expanding the system’s ability to connect with other accounting software. We want to make it as plug-and-play as possible, allowing it to connect seamlessly with systems like SAP or Oracle.

Andrea: It all sounds very promising. Thank you both for joining us.

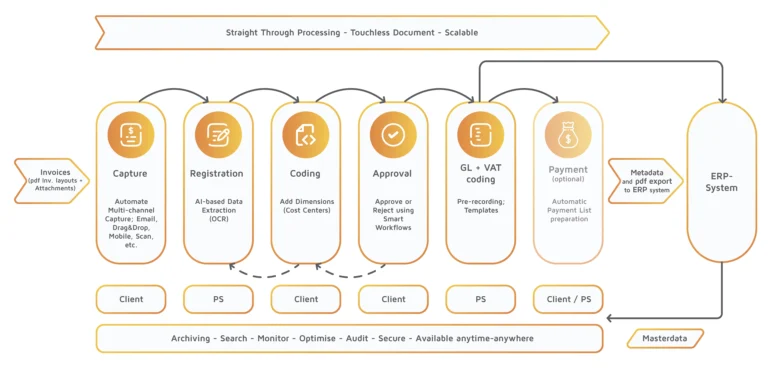

It’s also worth checking out the diagram that demonstrates how PS APPS works:

* * *

Our Digi-Blog posts about digital transformation:

6 – Digital transformation simplified – delivering quick results in the innovation maze

5 – Challenges of digital transformation from human perspective – Human behaviour-shaping factors

4 – Digital transformation – Human aspect challenges and key target groups of change management

3 – Change management and its cultural aspects in the digitalisation of accounting

2 – 5 Key goals for digital transformation in professional business services

1 – Digitalization – The engine of economic growth in the 21st century

Browse and read our previous blog posts here.

Follow us on LinkedIn!