Personal Income Tax

Cafeteria

Fringe benefits

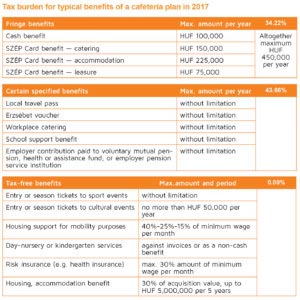

In accordance with the changes of Act CXVII on Personal Income Tax (hereinafter: PIT) effective from 1 January 2017 the potential number of preferential tax rated cafeteria items will decrease drastically. It will only be possible to grant fringe benefits to employees on the basis of two legal categories as follows:

- SZÉP Card’s annual frame amount is not going to change, payments can be transferred to the existing sub-accounts.

- The other item with preferential taxation will be the cash benefit up to HUF 100,000 per year.

The employer’s burden will be 34.22%. The combined value of these two fringe benefits should not exceed the annual amount of HUF 450,000. If the employment starts during the year, the cap should be apportioned in accordance with the days spent in employment.

The tax base multiplier applicable to the fringe benefits will be reduced from 1.19 to 1.18. The employer will pay the 15% PIT and the 14% health care charge on this amount.

Certain specific benefits

Most of the popular and well-known benefits are removed from the scope of preferential tax rated circle, involving the Erzsébet voucher, the school support benefit, the local travel pass, the coverage of school system based educational costs, and the employer contribution paid to voluntary mutual pension, health or assistance fund, or employer pension service institution. Effective from 1 January 2017, these benefits will have a burden of 43.66% instead of the burden of 34.51% paid until 31 December 2016, but will have no upper amount limits.

Unlike the preliminary plans, the employers may provide various health related services to their employees with less beneficial conditions.

In line with the law on voluntary mutual insurance funds, there are several services (e.g. health reservation program, health screening) which can be provided to the employees tax free. To do so, the Fund should establish a contractual relationship with the employer or with a third party supporter specifying the beneficiaries. These services should be described in the Fund’s memorandum of association. The employer or the third party supporter can choose from these services, which it intends to finance.

Tax free benefits

From next year, the number of tax free benefits will grow.

- Accommodation allowance for promoting the mobility of employees

Under specified conditions, for five years, the maximum amount of the support is

- not more than 40% of minimum wage in the first 24 months of the employment;

- 25% of minimum wage in the second 24 months of the employment;

- 15% of minimum wage in the following 12 months.

The base of the support is the invoice of flat rent either by employer or employee.

- From next year, in addition to day-nursery services, employers may also provide tax free kindergarten services to employees (free of charge or at a discount as non-cash benefit), by reimbursing the costs of day-time child care against invoice, even in an institution established and/or run by the employer.

- In relation with the tax free housing or accommodation benefit, the eligibility criteria is modified: the new provisions contain further specifications regarding the definition of eligible rooms and eligible family members moving into the accommodation. The new regulation can be adopted retroactively from 1 August 2016.

Other changes and transitional provisions

The new legislation resolves the ambiguities of law interpretation by clarifying the definitions of official business travel and assignment. Thanks for the harmonization of terminologies, the law on PIT now refers the same by definition as the Labour Code .

Under the transitional provision, those benefits whose status will change from fringe benefits to certain specified benefits as of 1 January 2017, can only be given as certain specified benefits with higher tax burden after 31 December 2016.

Changes affecting consolidated tax base

Travel allowance and other expense reimbursements paid without invoices

From 1 January 2017, the tax free travel allowance benefit on vehicles owned by private individuals (for commute to work) will raise from HUF 9 to HUF 15 per kilometres. The same change applies to the standard cost rate for passenger cars.

In view of the decrease of social contribution and health contribution paid by the employer, in those cases where the private individual is liable to pay one of the 22% contributions, the 82% of the assessed income has to be treated as tax base (instead of the previous rate of 78%).

Tax base allowances

First marriage tax based allowance

The first marriage tax base allowance would be applicable for couples married after the 31 December 2014 in tandem with the family tax base allowance. The allowance can be claimed retroactively. Earlier, the two allowances could not be claimed at the same time; when the couple became entitled for a family tax based allowance, individuals lost their right for the first marriage tax allowance. In accordance with the new regulation, the two allowance can be claimed in the first 24 months of the marriage at the same time.

According to the transitional provisions, the new regulations are applicable retroactively for the 2015 PIT return by self revision.

Family tax based allowance

As of 1 January 2017, the amount of the allowance after two children raises from the current HUF 83,330 to 100,000 per child.

Definition of secondment and business trip

Earlier, the law defined the secondment as business travel and/or work performed at any location other than specified in the employment contract. Commuting to and from the workplace was not included in this definition. According to the changes, secondment will continue to be regarded as business travel and the benefits provided to employees in relation to secondment still will be subject to preferential tax rates. As of 26 November 2016, all travelling (with the exception of commuting) done on behalf of the employer is considered as a secondment, as well as the work performed at any location other than specified in the employment contract. The law also specifies the definition of “work place”.

Tax return filing methods

From next year, the opportunity to file tax return proposals or simplified tax declarations will be overruled. The draft tax declaration will take the previous two methods’ place, and will be based on data reported to the tax authority during the year. The tax authority will prepare draft PIT return for taxpayers who either did not request their employers to prepare it or their request was rejected. The draft tax return will be prepared by the authority for those individuals who are registered for electronic tax filing. Those individuals can also request the tax authority to prepare their draft returns who are not registered for electronic tax filing, but they have to file a written request not later than 15 March 2016.

The draft tax declarations can be corrected and/or supplemented until 20 May. The acceptance of the draft declaration is regarded as the individual’s tax declaration.

The ‘53’ tax return and declaration prepared by the employer are also possible ways of fulfilling legal obligations.

Taxation of non-resident artists

The new regulation provides option not only for performing artists but also for their staff involved in the production of films to chose simplified taxation.

The simplified taxation will be available also for those non-resident taxpayers of film industry who stay longer than 183 days in Hungary. The only modification is in the taxe-base definition: the reimbursement of travel and accommodation expenses will not be part of the income. In the simplified taxation no expense reports can be taken into consideration.

Flat rate tax occupancy tax

As for the Airbnb hosts, the itemised flat rate tax (paid by rooms) will be raised from the current HUF 32,000 to 38,400, while parallel with this, their health care tax liability will be eliminated.

Health contribution paid by the employer

At the same time with the decrease of the social contribution, the rate of health contribution payable by employers will also decrease to 22% from the previous 27% rate.

The 6% health contribution payable on interest income and on income from long term investments will be abolished as of 1 January 2017. Also, the 20% health contribution will be abolished for private individuals opting to pay flat rate occupancy tax.

As a result of the above changes, the number of health contribution tax rates will decrease from 5 to 2 (14% and 22%).

Social Security

Decrease of contribution

The social contribution rate will decrease to 22% as of 1 January 2017 from the previous 27% rate, and a further 2% decrease shall be expected from 2018.

Based on the agreement between the employers organisation and the government, the minimum wage will increase by 15% and the guaranteed wage minimum by 25% in 2017. The amount of minimum wage is HUF 127,500 the amount of the guaranteed wage minimum is HUF 161,000 in 2017.

The reduction of the social contribution tax rate will have an impact on the allowances available on the social contribution tax.

Legal relationships not resulting in social security liability

As of 1 January 2017, undergraduates working under the national higher educational law will not be subject to social security. This change basically follows the change of the relevant definition in the higher educational law, i.e. undergraduates may work not only in the frame of a (partial) training program but also in a dual education performed on a work field. As a result, the number of forms of work not resulting in social security liability increased.

Change of secondment related social security regulations

In line with our earlier newsletter, as of 16 June 2016 third country nationals assigned/hired to Hungary are — under circumstances — not subject to Hungarian social security. This regulation applies also to those third country (insured) individuals, whose countries do not have an (international) social security agreement with Hungary or, to such individuals who do not fall under the EU social security regulation. The extended exemption applies also to secondments started in 2016.

Under the current rules, i.e. with the extended exemption secondments lasting for more than 2 years may result in Hungarian social security exemption until even the end of the secondments, provided the employee reported the vis major extension of the assignment to the tax authority.

As of 2017, the above extended exemption possibility will be terminated. As a result, Hungarian social security liability will be due after the two years of secondments if the individual continues his Hungarian assignment. This means that currently with the report of the assignment extension the individuals will be exempted from Hungarian social security until the end of the assignment. Based on the new rules, reporting the extension of the assignment within 8 days will result in the Hungarian social security exemption only until the end of the two years. Based on the transitional rules, if the assignment extension is reported to the tax authority until the end of 2016, Hungarian social security exemption is available by 30 June 2017.

In line with the social security law changes, the scope of taxpayers, who started their assignment after 1 January 2016, eligible to social security allowance is extended.

Currently there is however a difference between employer and employee social security liabilities in terms of the assignment extension regulations: the extension does not mean exemption from employer social security liability, instead the extension results in employer social security liability retroactively from the starting date of the assignment. As of 2017, this difference will be terminated: the employer social security liability will be due only after the two years assignment (if extension will take place).

Social Contribution Tax

Benefits not subject to social contribution tax

With retroactive effect from 1 July 2015, the law clarifies that any income paid for a period, until which the individual was not subject to Hungarian social security, is not subject to social contribution tax, irrespective of the timing of the payment. This clarification validates the previous practice, i.e. when an individual was not subject to Hungarian social security (e.g. diplomats, citizens of a third country assigned to Hungary up to two years, foreign actors, undergraduate employees), then social contribution tax was also not payable.

Tax allowances

Maternity allowances

As of 2013 employers are eligible for social security allowances after employees being on maternity leave and receiving various maternity allowances (GYED, GYES). Currently there are two types of allowances: there is a three years long digressive allowance after employees being on maternity leave and after at least 3 children employees are eligible for a 5 years digressive social security allowance, if the employee is eligible for family allowance.

The new regulations clarify that the eligibility conditions should be reviewed at the beginning of the beneficial employment relationship and that these allowances can be obtained fully and parallel.

Career allowance

The allowance was re-introduced as of 1 August 2016. The new regulation specifies the scope of the eligibility, since it includes the so called state service relations as well. This regulation entered into force on 26 November 2016.

Other allowance related regulations

There is a definition clarification on the allowance after permanently unemployed individuals, i.e. when determining the eligibility period of the unemployment, the public servant period will also count. This means that employers are eligible to this allowance also after public servants.

Training fund contribution

There is a change in the training fund contribution allowances after training organized for employees. Earlier, to be eligible to this allowance employers (including joint and partner companies) had to provide technical training for at least 45 undergraduates per month. The new regulation decreases this number to 30 and the eligibility period should be observed not on a monthly basis but in a January–June and September–December period, i.e. this allowance will become available for a wider range of undertakings.

Rehabilitation fund contribution

As of 1 January 2017, the amount of the rehabilitation fund contribution will increase and the method of determining this liability will also change. Earlier, the rehabilitation fund contribution was HUF 964,500 per year, but as of 2017 ninefold of the actual minimal wage should be paid in this respect.

Value Added Tax

Goods and services with preferential tax rate

As of 1 January 2017 some basic food products (poultry meat, eggs, fresh milk) are going to be subject of the 5% preferential rate. The provision of internet service and restaurant service will be taxed with a rate of 18%. The rate applicable for restaurant service is expected to be decreased further to 5% as of 1 January 2018 — in the same time, however, a new tax (tourism development contribution) will be introduced on restaurant services, levied on the net revenues derived from such services at the rate of 4%.

Requirements regarding the content of invoices

From next year the first 8 digit of the customer’s VAT identification number will have to be included on the invoice also in domestic relation if the amount of the output tax equals or exceeds HUF 100,000 (the current limit is HUF 1 million).

As of 1 July 2017 these invoices will also have to be included in the domestic VAT summary report. The ministerial decree prescribing the exact reporting requirements is still to be issued.

Reverse charge

Starting from next year reverse charge mechanism shall be applied also to those construction services which are not subject to prior authorization and only required to be reported to the competent authorities.

Individual exemption

The upper limit on the value of supplies allowing for the eligibility for the individual exemption status will be raised from HUF 6 million to HUF 8 million. Taxpayers who managed to stay below the new upper limit of HUF 8 million in 2016 (and also do not expect to reach it in 2017) can already choose individual exemption for 2017.

Excise Tax

Most new regulations pertaining to the excise tax will come into force as of 1 April 2017 mainly effecting tobacco products (definition, the amount of tax, tax payment obligation, etc.) and the way electronic administration shall be handled.

Advertisement Tax

Residency of the publisher

The changes in advertisement tax threatens with a crackdown on those global corporations (Google, Facebook) which the government is determined to tax despite the fact that they are not established within the territory of Hungary.

Publisher of the advertisement

It has been clarified that in case of advertisements published on the internet the person entitled to dispose of the advertising space shall be regarded as publisher of the advertisement.

Register on publishers

As of 2017 publishers with net tax debts exceeding HUF 100,000 will be deleted from the Register of Publishers maintained by the tax authority (meaning that from 2017 tax authority will consider the aggregated tax account balance of the publishers when deciding on the deletion).

Stamp Duty

From 2017 the currently available preferential rate of 2% on the real estate acquisition of property dealers and leasing companies will be replaced by two rates (2% and 3%). The lower rate of 2% will be available under two conditions: first, the new owner of the property shall declare that the property will be sold in 2 years (so far this is in tune with current regulations) and moreover, the prospective customer will also have to obtain ownership over the property within the mentioned time frame. If eventually the contract is not fulfilled within 2 years, a surcharge will be levied. In contrast to the above the application of the higher rate of 3% is not bound by such contracting requirement (here a simple declaration suffices). This also means that there is no risk of a surcharge if the 3% rate is applied.

From 1 January 2017 no gift or transfer duty will be payable on the acquisition of the right to use of land as laid out under the Act on the Transactions of Agricultural and Forestry Land.

From 1 January 2017 the exemptions relating to the acquisition of environment friendly vehicles will not be considered as de minimis support.

Please be reminded that — as highlighted in our previous newsletter — the calculation method to be applied when determining the equity participation rate in a company holding domestic real estate assets will also change from 2017.

Company Car Tax

As of 1 January 2017 company car tax liability for passenger cars financed via operating lease will be shifted to the lessor (again). Passenger cars leased out for individuals will also be subject to tax provided on such cars only depreciation is accounted for.

Financial Transaction Duty

Taxable persons

From 1 January 2017 the circle of taxable persons will be extended to include also those financial institutions which are engaged in credit provision or cash-loan lending but do not qualify as payment service providers. In their case the base for the transaction duty will be constituted by the amount of loan repayments, whether received in cash or in scriptural form.

Rules of Taxation

Changes pertaining to reliable and risky taxpayers

Reliable taxpayer

The list of conditions to be met to earn the reliable taxpayer status has been supplemented with a new item which requires a positive balance of the total taxes due from the taxpayer in a tax year. With this amendment the tax authority seeks to squeeze abuses involving dormant companies.

According to the new regulations a taxpayer may qualify as reliable if no collection procedures were initiated against it by the tax authority in any of the 4 years preceding the current tax year (as opposed to the 5 years required previously).

In relation with another condition the concept of default penalty was extended to also include excise fines. This means that receiving an excise penalty can also lead to the cancellation of ‘reliable’ rating.

The above changes in rating will be first applied by the tax authority for evaluation periods following the first quarter of 2017.

In addition to the currently available instalment payment facility, automatic payment facilitations accessible for reliable taxpayers on tax debt will be extended to also include deferred payment facilities up to the amount of HUF 1.5 million (formerly HUF 500,000). Taxpayers considering to take advantage of the above payment options should be aware that from 2017 the tax authority will cease to send out quarterly reminders on the availability of these facilities.

Risky taxpayer

Taxpayers will automatically be rated as risky taxpayers if their seat is registered with a seat provider and are penalized due to the obstruction of tax administrative proceedings in 2017 or were already penalized in any of the 3 preceding years. In relation to the above, the concept of seat providers have been introduced by the law, and — in order to safeguard against abuses — reporting obligations have also been imposed on the entities offering such services.

Objections challenging the ratings will have to be submitted within 3 months’ time (as opposed to the currently available period of 6 months).

Tax registration procedure

A new item will be added to the list of eligible excuses to challenge the tax authority’s decision to refuse granting a tax number.

Since 2012 — instead of being automatically granted — tax numbers are issued upon a risk assessment process performed by the tax authority. Among other reasons, the tax authority shall refuse to issue a tax number if the applicant taxpayer’s shareholder currently holds or previously held executive position or shares in an already existing company with delinquent tax liabilities. According to the new regulations, when weighting the facts, the tax authority shall also examine and consider the role and the level of involvement the shareholder had in the infringements leading up to those liabilities.

Supporting procedure

Starting from 2017 the tax authority can decide to conduct a new procedure — instead of a straightforward tax audit —which can be applied to any taxpayers regardless of their rating. Under the so called ‘supporting procedure’ taxpayers can be called upon for self revision and can be provided professional guidance by the tax authority, enabling them to remedy infringements without being pulled through a generic tax audit procedure involving the looming prospect of penalties.

Data provision requirements

Reporting obligation of automobile dealers as VAT subjects will be extended to also include the vehicle identification number of passenger cars in case of sale, intra community acquisition or import.

The paperwork behind dividend payment to domestic private individuals will be simplified requiring only the provision of personal identification data.

Corporate Income Tax

Changes in tax rate

From 2017 the tax rate is lowered to 9% irrespective of the amount of the tax base.

Obtaining tax advantage

If the main motive behind a transaction is to obtain tax advantage then the expenses incurred in relation with such transaction will be deemed non-deductable and the tax advantage (exemption or benefit) itself that the entity intended to gain will not be permitted to be invoked. This represents a fundamental change in the approach of the regulation as previously only transactions with the sole purpose of tax evasion were deemed illegitimate.

Preferential business transformation, transfer of assets

The conditions set for preferential business transformation and preferential transfer of assets have been supplemented with a new one: the transaction has to be based on valid economic or commercial reasons and it is for the taxpayer to prove the existence of such underlying reasons.

Minimum tax base

Only in the event of preferential business transformations will the predecessor entity be permitted to reduce its minimum tax base with the amount of the income or exchange gain incurred due to the acquisition of the share holding in the new entity (previously the preferential nature of the transformation has not been a requirement).

Promoting the mobility of employees

Expenses incurred in relation to the accommodation allowance promoting the mobility of employees or to the creation and maintenance of workers’ hostels will constitute a tax base decreasing item up to the extent of pre-tax profits.

Tax benefit for start-up enterprises

Pre-tax profits will be allowed to be reduced by the threefold value of the acquired shares (or capital increase) of those companies which meet the specified requirements. The benefit will be claimable in the year of acquisition and during the following three tax years in equal parts, capped at HUF 20 million per tax year.

If the stakes held in start-up companies are disposed of within three years, pre-tax profits will have to be increased with the twofold amount of the tax benefit claimed previously. Impairment losses recognized on these shares shall also be accounted as tax-base increasing item up to the amount of the benefit formerly claimed.

SME investment allowance

By eliminating the former limit of HUF 30 million, from 2017 small and medium-sized enterprises can reduce their pre-tax profits with the full value of new acquisitions of fixed assets, software use right, intellectual property and the cost of expanding, remodelling and converting real estate properties.

Tax savings achieved this way shall be regarded as agricultural, de minimis or SME allowance.

Tax benefit of historical buildings

According to a change adopted in the summer of 2016, from 2017 the maintenance cost of buildings classified as historical monuments — on top of being tax deductive — will also be eligible to reduce the tax base up to 50% of the pre-tax profits.

In addition, the renovation cost of these buildings will be allowed to be recognized three times: on top of being tax deductive expenses in themselves, pre-tax profits can further be reduced with twice the amount of the renovation costs. The benefit can be claimed in the year of completion or in the following five years at the discretion of the taxpayer. The reduction has no upper limit meaning that the deductions are allowed to push the tax base into the red.

If that is not enough, these benefits can be claimed also by the affiliated companies of the eligible entity jointly or separately up to the amount of EUR 50 million per year.

Irrecoverable debts

In the future the 20% amount of intercompany receivables which are overdue for more than 365 days can only be utilised to decrease the tax base if the taxpayer also provides data about the particulars of the related party and the reasons behind the irrecoverability of the receivable.

Agricultural Compensation Fund

From 2017, in addition to the amounts transferred to the Magyar Kármentő Alap and the Nemzeti Kultúrális Alap, 50% of the amounts voluntarily transferred to the Mezőgazdasági Kárenyhítési Alap (Agricultural Compensation Fund) can also be considered as tax base decreasing items, up to the amount of pre-tax profits.

Tax base increasing items

Foundations, associations and public bodies will have to add back their costs incurred in relation with the utilisation of property to their tax base even if they do not perform business activities at all.

In case of preferential transfer of assets, the transferring company has to increase its tax base with the amount of tax deduction it had claimed earlier in relation with the asset transfer if the participation received in exchange for its assets is sold before the deferred corporate tax is paid.

Loss carry forward

50% of the negative tax base incurred due to the application of R&D tax deductions will be allowed to carry forward but only if the company has also claimed social security tax allowance in respect of its R&D activity.

Transfer pricing

As of 2018 the reduction of higher tax base on account of transfer prices deviating from the arms length price will only be allowed to reduced if the related party also performs the corresponding adjustment on his end i.e. increases its tax base. Currently there is no such pre-condition; a statement confirming the amount of tax adjustment is the only thing that is presently required from the other party.

Transactions involving a foreign company and its Hungarian branch will have to be documented only if those transactions are taxable in Hungary (according to the double tax treaty in place).

Supporting spectator sports

A company supporting spectator sports will be allowed to accept consideration in exchange for its donation only up to the amount of the ’complementary sports development grant’. Displaying the name of the supporter is not regarded as consideration.

According to another modification, in order to gain eligibility for the tax benefit, the supporter will not be required to actually settle the complementary sport development grant by the end of the tax year; it will be possible to arrange for the transfer until the date of CIT return filing. However, in such case, the supporter will only be able to claim 80% of the tax benefit that would potentially be available.

Furthermore, it will be possible to utilize the tax benefit for two years longer than before; i.e. it could be claimed till the end of the eighth tax year following the donation. This will also apply for grants provided to cinematographic works and to the Associations for the Protection of Performer’s Rights.

Tax benefit for SMEs

Small and medium sized enterprises will be allowed to claim tax allowance on the full amount of their interest payments on fixed asset loans provided by financial institutions. In addition, the cap of HUF 6 million on such allowances has also been abolished. Previously the amount of tax allowance was limited to 40% of interest payments in case of loans granted after 2000 and to 60% of interest payments on loans granted after 2013.

Tax benefit of development

The requirements pertaining to head count and salary cost increase prescribed for the eligibility for development tax benefit available for major investments will significantly be reduced from 2017, making such benefits accessible for a larger number of entities. In addition taxpayers will be allowed to make use of the benefit for 12 years (availability is currently limited to 8 years).

Tax benefit of investments increasing energy efficiency

A new tax benefit will be introduced for investments aiming to increase energy efficiency. It will be possible to claim 30% of the total cost of such investments as tax benefit (which can be upped by an additional 10% and 20% in case of a medium sized enterprise and a small sized enterprise, respectively) in the year of capitalization and during the following 5 years. The benefit will be capped at EUR 15 million.

Tax benefit of live music service

It will be possible to claim tax benefit up to 50% of the costs associated to live music performed at restaurants and wine cellars. This kind of tax benefit will be considered as de minimis support.

If the tax benefit is claimed, the pre-tax profit should be increased with the costs of live music service.

Depreciation

Leased out patents, intellectual properties, know-hows, trademarks, trade names, business secrets and copyright protected materials will be allowed to be depreciated by the lender with a rate of 30% from 2017.

Business expenses

Supports without repayment obligation, services free of charge and the value of assets transferred free of charge will not increase the corporate tax base if provided for subjects of KIVA.

Transactions carried out free of charge will have to conform to stricter rules to be recognized as business expenses. As of 2017 upon filing its tax return the party on the receiving end will have to issue also a statement declaring that the corporate tax have been paid on the income resulting from the said transaction. If the receiving party does not conduct any business activities, his declaration of this fact will also suffice to exempt the provider party from the obligation to increase the tax base on his end.

Expenses incurred on account of workplace nurseries will be recognized as business expense in the future.

IFRS

Companies reporting under IFRS will be subjected to special tax base adjustments. Further information on this topic will be released in a separate newsletter.

Local Taxes

Local business tax

The changes introduced to the definition of licence fee under the Act on Corporate Income Tax have mostly been mirrored also under the Act on Local Taxes, except that the base of local business tax will be allowed to be reduced by the income deriving from a licence fee transaction, as before (under Corporate Income Tax it is the profit that will be eligible for the 50% tax allowance).

Pursuant to a previous amendment businesses are allowed to file their local business tax returns also with the tax authority which in turn forwards these returns to the competent municipalities. This regulation has been supplemented with the option to make use of the mediation of the tax authority also in respect of revised tax filings. However, please note that the tax authority will only forward returns which are filed electronically.

Affiliated companies will only be required to combine their tax base for progressive taxation if the totals of their cost of goods sold and services mediated exceeds 50% of their sales revenue, and their affiliated status is due to a de-merge which took place after 1 October 2016. This provision is to be applied to tax years beginning after 30 September 2016.

To address certain practical issues of those companies under IFRS the Act on Local Tax has been supplemented with several new provisions which will also be detailed in a coming newsletter.

Building tax and land tax

Foundations will only be exempted from building tax and land tax if they are registered as owners of such property in the land registry and the property is utilised in close relation with their main activity. As further condition, the tax authority shall also be notified of this fact in writing annually by the end of each May.

To prevent abuses with regard to the tax exemption of urban properties with an area of less than 1 hectare under agricultural use, the requirements to be fulfilled for the tax exemption of such properties will be tightened.

From 2018 local governments will be able to levy property tax also on billboards, capped at the annual amount of HUF 12,000 per m2.

Other Taxes

Small business tax (KIVA) and small business taxpayers (KATA)

The reduction of corporate tax rate will not leave the rate of KIVA unaffected, which is reduced from 16% to 14% in 2017 and is expected to settle at 13% in 2018.

Head count limit set as a criteria for the availability of KIVA tax scheme has been increased to a maximum of 50 employee (from the current number of 25). Consequently, the upper head count limit over which a taxpayer under KIVA will be compelled to abandon this tax scheme has been elevated to 100 (from the current limit of 50).

Although the KIVA scheme is only available for those under the sales revenues of HUF 500 million, according to a new provision an existing KIVA status can be retained as long as sales revenues stay below HUF 1 billion.

The upper revenue limit up to which the favourable rules of KATA apply will be increased to HUF 12 million from the current amount of HUF 6 million. However, please note that the threshold set for individual VAT exemption will only be elevated to HUF 8 million (from HUF 6 million) meaning that the limit set for KATA and the limit set for VAT exemption will not sync any more.

Environmental product fee

The definition of contract manufacturing has been modified: from 2017 contract manufacturers during the manufacturing process cannot contribute more than 50% of the weight of the initial product subject to environmental product fee.

The option to choose the payment of flat rate product charge on passenger cars and motorbikes was introduced in 2016. From 2017 this will be extended to trucks and buses as well.

Plastic bags used for selective waste collection, biodegradable plastic products manufactured using exclusively renewable sources, and products created during preparation for recycling will be exempted from environmental product fee liability.